The result is a highly efficient system where settlement details are not only accurately captured but also broken down comprehensively, including VAT calculations, which simplifies one of the most complex aspects of ecommerce accounting. Accurate bookkeeping ensures that all financial data reflects true transactions which aid in correct VAT calculations and other tax obligations. Competitive Advantage in a Crowded MarketCompeting effectively in the crowded e-commerce space requires lean operations and strategic focus on growth-oriented activities rather than administrative chores. In effect this means,every Amazon seller should consider utilizing Xero for their accounting needs because it not only optimizes financial management through automation but also enhances overall business efficiency by allowing sellers more time to focus on growth-oriented activities rather than mundane bookkeeping tasks. This high level of accuracy is critical for making informed business decisions and maintaining compliance with tax regulations. Overlooking Reconciliation ProcessesFailure to regularly reconcile Amazon payout reports with bank statements is another frequent oversight. By automating these critical yet labor-intensive tasks within the realms of ecommerce bookkeeping, businesses are poised to grow while ensuring compliance with fiscal regulations. When every transaction from sales to refunds and fees is automatically recorded, entrepreneurs can focus more on strategic business decisions rather than mundane tasks. read about the best Amazon to xero integration Reviewing and Reconciling AccountsThe final step involves regularly reviewing and reconciling the accounts in Xero to ensure accuracy in financial reporting. This setup phase ensures that all future transactions from Amazon are categorized correctly in Xero without further manual intervention.

This meticulous approach helps safeguard against common pitfalls such as incorrect VAT returns which could lead to legal complications or financial penalties. This methodical approach helps avoid overpayments or underpayments of taxes which could otherwise impact your financial standing. Amazon tax compliance in Xero Comparing Manual vs Automated Bookkeeping for Online BusinessesManual Bookkeeping: The Traditional ApproachManual bookkeeping has been the backbone of financial management for centuries. The result is a reliable financial dataset readily available for analysis and reporting. This precise matching makes reconciliation a straightforward task requiring just a single click to approve entries, thereby enhancing efficiency and reducing potential errors. This step is essential not only for accurate bookkeeping but also for maintaining compliance with tax laws and regulations. This integration streamlines the accounting process by automatically syncing Amazon payout data with Xero, ensuring that all transactions are accurately recorded. Link My Books automates the bookkeeping process by syncing Amazon payout data directly into Xero. The process includes a detailed breakdown of all transactions, such as sales, refunds, fees, and VAT calculations.

Streamline Reconciliation ProcessesOnce your Amazon payout data is synced with Xero through automation, reconciliation becomes a breeze. Streamlined Operations and Cost EfficiencyAmazon accounting can be complex and time-consuming if done manually. With automated solutions ensuring precise calculations and timely submissions, they not only avoided penalties but also optimized their tax efficiency. With a well-integrated Amazon FBA and Xero system, ecommerce owners can rest assured that their bookkeeping is not only precise but optimized for maximum tax efficiency. Focus on Business GrowthThe core benefit of using Xero for your Amazon store lies in how much it frees up business owners' time. Single-Click ReconciliationOne of the biggest advantages of using Xero integrated with Amazon is the ease of reconciliation. The assurance that your financial records are accurately maintained means you can make informed decisions quicker and adapt more responsively to market changes. Amazon to xero integration Every time a payout from Amazon is received, an invoice summarizing all financial activities-sales, refunds, fees-is automatically generated in Xero. Using Xero for accounting significantly simplifies this aspect by automating the sync of payout data from Amazon to Xero.

Detailed Breakdowns for Better ClarityEach payout from Amazon is accompanied by a detailed breakdown in Xero, thanks to specialized integration tools like Link My Books. This automation not only reduces the likelihood of human error but also speeds up the entire bookkeeping process. Building a Solid Foundation: Best Practices in Ecommerce Finance ManagementUnderstanding Ecommerce Financial ManagementManaging finances effectively is critical for any ecommerce business, especially when integrating systems like Amazon and Xero. This not only simplifies the financial overview but also aids in deeper analysis. In effect this meansStreamlining ecommerce finances through effective integration between Amazon sales channels and Xero not only simplifies the entire accounting process but significantly boosts efficiency and accuracy. You can see exactly where money is being made and spent. Accurate accounts help avoid costly mistakes with VAT returns and other tax obligations potentially leading to penalties or legal issues. Simplifying Reconciliation ProcessesThe reconciliation process can be one of the most time-consuming tasks in accounting if done manually. Boosting Competitive Advantage through Efficient Bookkeeping PracticesStreamlining Accounting with AutomationThe integration of Amazon and Xero transforms the arduous task of bookkeeping into a streamlined, error-free process.

Are you an Amazon FBA vendor drowning in a sea of financial data? You're not the only one. Lots of business owners struggle to keep their books in order while expanding their organization. Yet what if you could automate your audit and reclaim those priceless hours?

Invite to our detailed overview on automating Amazon FBA accounting with Link My Books. We'll show you exactly how to:

• Streamline your monetary processes

• Gain real-time insights right into your business efficiency

• Ensure tax conformity across several markets

• Save an average of 6+ hours each month on accounting

All set to transform your Amazon FBA accountancy from a frustration into a effective device for development? Allow's dive in and discover exactly how automation can change your company finances.

Key Takeaways:

- Link My Books is a specialized tool created to improve Amazon FBA audit, conserving you approximately 6+ hours each month on bookkeeping.- Automated accounting helps reduce hands-on monitoring mistakes, ensures precise cost monitoring, and preserves compliant financial documents.- The detailed overview covers setting up your account, connecting your Amazon Seller account, configuring tax settings, and syncing data.- Regular reconciliation and coverage are crucial for maintaining precise documents and streamlining tax obligation declaring.- Web link My Publications offers a complimentary 14-day test, enabling you to discover its features before dedicating to a paid strategy.

Amazon FBA ( Gratification by Amazon) accounting is a crucial element of running a successful e-commerce company on the platform. It entails monitoring and handling all economic deals connected to your Amazon vendor account.

Amazon FBA audit is the procedure of recording, categorizing, and examining financial information certain to your Amazon service. This includes:

- Sales revenue

- Amazon fees

- Stock costs

- Delivery expenses

- Tax responsibilities

Why is it Important?

Appropriate Amazon FBA accountancy is essential for:

1. Accurate profit computation

2. Tax obligation conformity

3. Company growth planning

4. Educated decision-making

Challenges of Amazon FBA Bookkeeping

Amazon vendors face one-of-a-kind accountancy challenges:

- Facility charge frameworks

- Multi-currency transactions

- Stock assessment

- Sales tax across different jurisdictions

Key Financial Information to Track

To preserve exact Amazon FBA bookkeeping, you need to keep an eye on:

- Daily sales

- Amazon fees ( recommendation, FBA, storage).

- Supply degrees and costs.

- Reimbursements and returns.

- Advertising expenses.

The Duty of Innovation.

Modern Amazon accounting relies greatly on specialized software application to:.

- Automate information collection.

- Integrate with accountancy systems.

- Produce real-time monetary records.

Automated accounting offers countless benefits for Amazon sellers, reinventing just how they manage their finances. Let's check out the key advantages:.

Time Financial savings.

Automated accountancy systems drastically decrease the time spent on manual information access and reconciliation. This allows sellers to focus a lot more on growing their business and much less on tiresome bookkeeping tasks.

Boosted Precision.

By eliminating human error, automated bookkeeping ensures extra exact monetary records. This precision is critical for making notified company decisions and maintaining conformity with tax obligation regulations.

Real-Time Financial Insights.

Automated systems supply current monetary details, making it possible for sellers to monitor their service efficiency in real-time. This prompt access to information assists in making quick, informed choices.

Boosted Compliance.

Automated accounting devices help maintain compliant monetary records by remaining updated with the most up to date tax obligation regulations and laws. This decreases the threat of pricey mistakes and possible audits.

Cost-efficient Option.

While there may be an first investment, automated accounting often verifies more cost-effective over time. It decreases the requirement for manual accounting and minimizes expensive errors.

Scalability.

As your Amazon business expands, automated accounting systems can easily handle enhanced purchase volumes without needing substantial added resources.

Link My Publications is a customized device created to transform Amazon FBA bookkeeping. Substantiated of the need for a much more reliable and exact way to handle monetary information for Amazon vendors, this software has quickly become a best remedy for e-commerce entrepreneurs.

A Game-Changer in Amazon Bookkeeping.

Link My Books sticks out as a effective ally for Amazon vendors, providing a detailed collection of functions customized particularly to the one-of-a-kind difficulties of FBA audit. By automating complicated processes and supplying real-time insights, it encourages vendors to concentrate on expanding their business instead of obtaining slowed down in economic trivial matters.

Smooth Assimilation with Popular Operatings Systems.

One of the key strengths of Web link My Books is its ability to integrate perfectly with preferred bookkeeping platforms like Xero and QuickBooks. This combination makes certain that your financial information streams efficiently between your Amazon vendor account and your recommended bookkeeping software program, eliminating the need for manual data entrance and lowering the risk of errors.

Secret Takeaway: Link My Publications is a specialized, integration-friendly device that streamlines and automates Amazon FBA bookkeeping, making it an necessary possession for e-commerce entrepreneurs.

Features of Web Link My Publications.

Link My Books supplies a detailed collection of functions created to simplify Amazon FBA bookkeeping:.

Automated Information Sync.

Link My Publications instantly syncs your Amazon vendor data with your audit software application, eliminating hand-operated information entry and decreasing mistakes. This real-time synchronization ensures your monetary documents are constantly current.

Thorough Financial Reports.

The system produces in-depth records, including revenue and loss declarations, annual report, and cash flow analyses. These records give useful insights into your service performance and aid you make informed choices.

Multi-Marketplace Support.

Link My Books sustains all Amazon industries around the world, making it suitable for vendors operating in numerous areas. It settles information from various markets right into a solitary, easy-to-manage account.

Tax Obligation Conformity Tools.

The software program includes integrated tax compliance devices that assist you browse complex tax obligation policies across different territories. It instantly determines sales tax, VAT, and various other suitable tax obligations, guaranteeing you stay compliant.

Inventory Monitoring.

Connect My Books offers durable inventory monitoring features, aiding you keep exact stock levels and evaluations. This is crucial for appropriate bookkeeping and financial reporting in Amazon FBA businesses.

Key Takeaway: Link My Books gives a thorough set of features customized for Amazon sellers, including automated information sync, detailed coverage, multi-marketplace support, tax obligation compliance tools, and supply administration.

Setting Up Your Web Link My Books Account.

To start automating your Amazon FBA bookkeeping with Web link My Books, start by producing an account. Go to the Web link My Publications web site and click on the " Register" button. Enter your e-mail address and produce a solid password. Once signed up, you'll have access to a complimentary 14-day trial to check out the system's functions.

During the arrangement process, you'll be prompted to provide basic information regarding your Amazon business. This includes your company name, signed up office address, and the markets you sell on. This details aids Connect My Publications tailor its solutions to your specific requirements.

Connecting Your Amazon Vendor Account.

The next essential action is connecting your Amazon Vendor Central account to Connect My Publications. This link allows the software program to access your sales information, charges, and other monetary information.

1. Visit to your Web link My Publications account.

2. Navigate to the " Assimilations" section.

3. Select "Amazon" from the list of available integrations.

4. Adhere to the triggers to license Link My Publications to access your Amazon information.

As soon as linked, Link My Books will start importing your historic information, generally going back approximately 18 months. This process ensures you have a extensive sight of your financial background.

Configuring Tax Obligation Setups.

Appropriate tax obligation configuration is vital for exact audit and conformity. Link My Publications provides advanced tax setups to manage numerous situations:.

1. Most likely to the " Setups" tab in your Web link My Publications account.

2. Select "Tax Settings".

3. Choose your home nation and the nations where you have tax obligation obligations.

4. Establish tax prices for every pertinent territory.

5. Set up item tax obligation codes if applicable.

Keep in mind, tax laws vary by region, so seek advice from a tax professional to ensure you're setting up every little thing correctly for your details situation.

Syncing and Reconciling Data.

With your account established and attached, Link My Publications will automatically sync your Amazon information daily. This consists of:.

- Sales transactions.

- Refunds and returns.

- Amazon costs.

- Stock activities.

To make certain accuracy:.

1. Frequently review the imported data.

2. Resolve your Link My Books documents with your Amazon records.

3. Attend to any type of inconsistencies promptly.

Utilizing Reporting Features.

Connect My Books supplies a variety of in-depth records to offer you insights into your Amazon service:.

- Earnings and Loss declarations.

- Annual report.

- Sales tax obligation reports.

- Stock appraisal records.

Make use of these records to make educated choices about your organization and prepare for tax filings.

Leveraging Support Resources.

Benefit from Link My Books' support sources to make the most of the benefits of automation:.

- Arrange an onboarding phone call with their group of professionals.

- Explore their knowledge base for in-depth overviews and tutorials.

- Reach out to customer assistance for tailored support.

By complying with these steps and using the complete abilities of Link My Books, you can significantly improve your Amazon FBA bookkeeping procedures, saving time and reducing mistakes.

Establishing Your Account.

Establishing your Link My Publications account is a uncomplicated procedure that can be completed in just a few mins. Right here's how to get started:.

Produce Your Account.

Begin by seeing the Web link My Publications site and clicking the " Subscribe" switch. You'll require to provide some basic details:.

- Your name.

- Email address.

- Password.

- Company name (if applicable).

Select Your Plan.

After developing your account, you'll be motivated to select a strategy that best fits your business demands:.

- Free test: Begin with a 14-day totally free test to discover all features.

- Paid plans: Pick from numerous choices based upon your deal volume.

Connect Your Accountancy Software Program.

Connect My Publications integrates effortlessly with prominent audit systems:.

1. Select your preferred software program (e.g., Xero, QuickBooks).

2. Follow the motivates to license the link.

3. Give required authorizations for data synchronization.

Confirm Your Organization Details.

Ensure your organization details is precise:.

- Validate your authorized office address.

- Update your tax identification numbers.

- Confirm your organization framework ( single proprietorship, LLC, and so on).

This action is important for maintaining compliant financial documents and producing accurate records.

Integrating your Amazon vendor account with Web link My Books is a critical step in automating your FBA accountancy. This process ensures smooth data flow between your Amazon company and your accounting software program.

Steps to Connect:.

1. Visit to your Web link My Books account.

2. Browse to the ' Links' tab.

3. Select 'Amazon' from the checklist of offered marketplaces.

4. Click 'Connect' and adhere to the prompts to authorize access.

Repairing Typical Issues:.

- Amazon Product Tax Code Error: If you experience this, double-check your product listings to guarantee all tax obligation codes are properly assigned.

- Consent Failing: Verify that you're utilizing the right Amazon seller credentials which your account remains in great standing.

Relevance of Proper Link:.

Developing a secure link allows for exact allotment of tax rates and makes sure all your monetary data is properly imported. This integration creates the foundation for accurate accounting and tax obligation compliance.

Setting Up Tax Setups.

Proper tax arrangement is vital for Amazon FBA vendors to ensure conformity and prevent costly errors. Link My Publications simplifies this procedure, making it less complicated to handle your tax commitments properly.

Establishing Tax Obligation Prices.

Connect My Publications permits you to set up tax obligation prices for different regions and product classifications. This function ensures that you're charging the correct amount of tax obligation on your sales, regardless of where your consumers lie.

Automating Tax Computations.

Once you have actually established your tax obligation prices, Link My Publications immediately determines and uses the proper tax to each deal. This automation removes the requirement for hands-on calculations, reducing the danger of mistakes and conserving you beneficial time.

Dealing With Tax Obligation Exceptions.

For clients that are tax-exempt, Link My Books offers options to handle these exceptions. You can quickly input and track tax-exempt purchases, ensuring your documents stay accurate and compliant.

Getting Tax Obligation Information.

Connect My Books produces comprehensive tax obligation records, making it much easier to file your income tax return. These records provide a clear breakdown of your tax obligation obligations, aiding you remain on top of your tax obligation duties.

Key Takeaway: Setting up tax obligation setups in Web link My Publications automates tax obligation computations, ensures compliance, and simplifies tax obligation coverage for Amazon FBA sellers.

Automating your Amazon FBA accountancy with Web link My Publications improves the daily recording of economic deals, making certain accurate and up-to-date records. This effective device deals with the complex job of summing up monetary information, supplying you with a clear photo of your organization's economic health.

Easy Data Synchronization.

Connect My Publications instantly synchronizes your Amazon vendor account data with your chosen audit software. This real-time synchronization eliminates the demand for hand-operated information entrance, minimizing errors and conserving you important time.

Comprehensive Deal Monitoring.

The software program keeps track of all transactions, including:.

- Sales.

- Reimbursements.

- Amazon fees.

- Inventory modifications.

This detailed tracking makes certain that no economic information slides via the splits, offering you a total summary of your Amazon business procedures.

Automated Settlement.

Link My Publications does automated reconciliation, matching your Amazon payments with the equivalent deals. This feature assists you swiftly recognize any discrepancies and resolve them quickly, keeping the precision of your financial records.

Trick Takeaway: Connect My Publications automates the syncing and settlement of your Amazon FBA monetary data, making sure accurate and updated records while saving you time and lowering mistakes.

Amazon FBA accountancy can be complex, yet complying with these ideal techniques will certainly assist you keep exact monetary records and streamline your procedures:.

Different Business and Personal Finances.

Keep your Amazon business funds different from your personal accounts. This splitting up is important for:.

- Accurate tracking of business expenses.

- Simplified tax obligation preparation.

- Clearer view of company efficiency.

On A Regular Basis Reconcile Your Accounts.

Carry out normal settlements to guarantee your economic information is accurate and current:.

- Contrast Amazon reports with your bookkeeping software application.

- Identify and fix inconsistencies promptly.

- Keep a clear audit route.

Keep Informed About Tax Obligation Obligations.

As an Amazon seller, recognizing your tax responsibilities is important:.

- Study sales tax requirements for every state you market in.

- Keep an eye on international tax obligation regulations if selling around the world.

- Take into consideration consulting a qualified accountant specializing in e-commerce.

Carry Out a Durable Inventory Monitoring System.

Exact inventory tracking is a vital part of bookkeeping for Amazon FBA vendors:.

- Frequently upgrade your stock matters.

- Track cost of goods offered ( GEARS) for each and every item.

- Display stock turn over rates.

Utilize Automated Equipment.

Utilize specialized Amazon audit software application to:.

- Minimize hands-on tracking mistakes.

- Conserve time on data entrance.

- Produce comprehensive records for far better decision-making.

Keep Thorough Records.

Maintain comprehensive records of all economic transactions:.

- Shop invoices and billings digitally.

- Paper all business expenses.

- Keep documents of Amazon fees and fees.

By following these finest methods, you'll develop a solid structure for your Amazon FBA accounting, making sure exact monetary documents and conformity with tax obligation regulations.

Secret Takeaway: Applying these ideal practices will aid Amazon FBA sellers preserve accurate monetary documents, abide by tax responsibilities, and make notified service decisions.

Regular settlement and coverage are crucial facets of maintaining accurate monetary records for your Amazon FBA service. By regularly examining and aligning your monetary information, you can make certain that your publications are updated and error-free.

The Importance of Normal Settlement.

Normal settlement helps you:.

- Determine inconsistencies in between your Amazon vendor account and accountancy software application.

- Catch and appropriate errors promptly.

- Maintain accurate documents of earnings and costs.

- Ensure all Amazon charges are appropriately made up.

Reporting Best Practices.

To simplify your coverage procedure:.

1. Establish a consistent timetable for generating reports (e.g., once a week or regular monthly).

2. Testimonial crucial monetary statements, including profit and loss reports and balance sheets.

3. Compare your records with Amazon's data to guarantee precision.

4. Use the insights acquired from these reports to make informed business decisions.

By carrying out these techniques, you'll be much better gotten ready for submitting tax returns and have a clearer understanding of your Amazon FBA company's economic health and wellness.

Key Takeaway: Routine settlement and coverage are vital for preserving accurate economic documents and making enlightened service decisions for your Amazon FBA venture.

Connect My Books comprehends that navigating Amazon FBA audit can be difficult, even with automated devices. That's why they use comprehensive support and resources to guarantee your success.

Expert Assistance.

The support team at Web link My Books includes ex-Amazon vendors and knowledgeable accounting professionals who understand the details of ecommerce accountancy. They're available to aid you with:.

- Setting up your account.

- Fixing integration problems.

- Responding to concerns concerning Amazon fees and taxes.

- Supplying support on financial reporting.

Data base.

To empower vendors with self-help choices, Link My Publications preserves an substantial data base. This resource covers:.

- Detailed tutorials.

- Frequently asked questions on typical accountancy issues.

- Best techniques for Amazon FBA accounting.

- Updates on new functions and combinations.

Webinars and Training Sessions.

Normal webinars and training sessions are offered to maintain you upgraded on:.

- Most current fads in ecommerce accountancy.

- New includes in the Link My Books system.

- Adjustments in Amazon's plans that affect accountancy.

Area Discussion forum.

Get in touch with other Amazon sellers and share experiences with the community discussion forum. This platform enables you to:.

- Review audit methods.

- Share suggestions for maximizing your FBA service.

- Get peer assistance for common challenges.

By leveraging these support resources, you can guarantee that you're making the most of computerized accounting for your Amazon FBA organization.

Secret Takeaway: Link My Books offers detailed assistance and sources, including skilled aid, a data base, training sessions, and a community forum, to help Amazon sellers be successful with computerized accountancy.

Link My Books offers a series of costs attributes and plans made to cater to the diverse requirements of Amazon vendors. These innovative choices give boosted performance and support for services seeking to maximize their accounting procedures.

Advanced Reporting.

Premium strategies include access to comprehensive economic records, providing deeper understandings right into your Amazon company performance. These records can aid you make data-driven decisions to improve success and development.

Multi-Channel Assimilation.

For sellers operating throughout multiple systems, costs features enable smooth integration with various other shopping channels, offering a merged sight of your entire company.

Priority Assistance.

Premium plan subscribers enjoy top priority access to Link My Publications' experienced assistance team, ensuring fast resolution of any type of problems or questions.

Personalization Options.

Advanced prepares deal better versatility in personalizing the software application to match your specific company requirements, consisting of customized tax setups and reporting layouts.

Extensive Free Trial.

While Web link My Publications provides a standard totally free test, premium strategies often include an prolonged test duration, allowing you to fully check out the sophisticated features before dedicating.

Trick Takeaway: Link My Books' premium plans supply innovative attributes and prolonged assistance to help Amazon sellers take their bookkeeping to the following degree.

Automated Amazon FBA accountancy offers a wealth of benefits for vendors. By leveraging these advantages successfully, you can change your business procedures and drive growth.

Streamlined Financial Administration.

Automated audit systems offer real-time insights right into your monetary health. This allows you to:.

- Screen cash flow very closely.

- Recognize rewarding items promptly.

- Spot patterns and patterns in sales information.

By having this details at your fingertips, you can make informed decisions regarding stock administration, rates techniques, and organization development.

Enhanced Tax Obligation Compliance.

Among one of the most considerable benefits of automated bookkeeping is boosted tax obligation conformity. The best Amazon bookkeeping software program services make sure:.

- Exact calculation of sales tax.

- Appropriate categorization of costs.

- Prompt filing of tax returns.

This lowers the risk of costly mistakes and prospective audits, offering you satisfaction and permitting you to focus on growing your organization.

Data-Driven Decision Making.

With automated systems, you have accessibility to detailed reports and analytics. Utilize this data to:.

- Assess the efficiency of different product lines.

- Assess the profitability of different markets.

- Identify locations for price reduction.

By basing your choices on strong data, you can maximize your operations and boost your bottom line.

Time and Source Financial Savings.

Automating your Amazon FBA bookkeeping liberates useful time and resources. Instead of spending hours on hand-operated data entry and settlement, you can:.

- Focus on item advancement.

- Boost customer service.

- Check out new advertising and marketing strategies.

This change in emphasis can cause considerable development opportunities for your business.

Scalability and Future-Proofing.

As your Amazon company grows, your audit demands will certainly end up being a lot more complex. Automated systems are made to scale with your organization, guaranteeing that your monetary documents remain accurate and certified as you expand.

Key Takeaway: Maximizing the benefits of automated Amazon FBA bookkeeping involves leveraging real-time understandings, ensuring tax conformity, making data-driven decisions, conserving time and resources, and getting ready for future growth.

Detailed Breakdown of SettlementsThe key to accurate VAT reporting lies in the granularity of financial data. Configuring Your PreferencesOnce the connection is established, it's crucial to configure your settings according to your specific accounting needs. This ensures that every transaction related to sales, refunds, and fees is captured accurately without manual input. Detailed Transaction AnalysisOnce the data is synchronized, the next phase involves delving deep into transaction details. Link My Books excels by providing clean summary invoices that mirror each deposit received from Amazon. In effect this means... Automated Bookkeeping: The Modern SolutionAutomated bookkeeping systems like Xero combined with Amazon integration tools streamline the entire accounting process.

Automated systems like those integrating Amazon with Xero reduce the risk of human error considerably by handling calculations and data entry automatically. Automation not only minimizes errors but also saves considerable time that can be better utilized in other areas of the business. Amazon seller cost of goods in Xero Errors in accounting can lead to severe compliance issues and financial discrepancies. For anyone trading on Amazon, leveraging these integrations can be a decisive step towards sustainable success. One such seller, a small toy manufacturer, found that manual tracking of sales, refunds, and fees was prone to errors and highly time-consuming. This not only saves valuable resources but also supports robust compliance with ever-evolving tax laws-ultimately securing a stronger foundation for sustainable business growth.

Since its inception in 2018, Link My Books has assisted over 8,000 Amazon sellers, many of whom previously encountered frequent bookkeeping errors that could adversely affect their VAT returns. Detailed Financial BreakdownsEach Amazon settlement is meticulously broken down into its component parts like sales, refunds, fees, VAT, etc., by Link My Books. With automated systems handling repetitive tasks, business owners find themselves with more time to focus on strategic decisions rather than getting bogged down by the intricacies of financial management. Businesses can leverage this precise data to optimize their tax submissions, potentially yielding savings and avoiding penalties associated with incorrect tax filings. The automation ensures that every financial movement related to Amazon sales is accurately represented in Xero, enhancing the reliability of financial reports. These invoices are crafted to mirror exactly the deposit received in your bank account which aids in effortless reconciliation.

Automated solutions like Link My Books ensure that there's minimal room for human error, thereby safeguarding businesses against potential financial discrepancies and tax issues. Case Studies: Success Stories from Sellers Who Switched to Automated AccountingStreamlining Operations with AutomationMany Amazon sellers have experienced significant benefits after integrating their accounts with automated accounting software like Xero. This level of detail is crucial for maintaining clear and precise financial records. It involves recording financial transactions by hand or using simple spreadsheets. This not only saves substantial time but also enhances the overall efficiency of financial management within the company. By leveraging these tools, businesses can ensure accuracy in their financial records, devote more time to growth strategies, manage taxes effectively, and ultimately position themselves strongly within competitive ecommerce landscapes.22.

Each payout from Amazon generates a summary invoice in Xero that matches exactly with bank deposits, making it easier to confirm that all transactions are accounted for correctly. Accurate and efficient bookkeeping not only saves time but also provides reliable data based on which strategic decisions can be made to outpace competitors and increase market share. In effect this means,that integrating Amazon to Xero through efficient tools such as Link My Books empowers businesses to enhance their competitive edge significantly.

Such detailed invoices mirror the actual deposits made into your bank accounts which aids in maintaining clarity and consistency across your financial reports. Focus on Business GrowthWith the technical aspect of bookkeeping taken care of by tools like Link My Books, ecommerce entrepreneurs can redirect their energies towards scaling their business operations and outperforming competitors.

Streamlined Reconciliation ProcessReconciling your bank statements with bookkeeping records can often be a daunting task. With accurate bookkeeping automated by Link My Books and synchronized with Xero, you can more effectively manage the financial health of your ecommerce business.

The less time spent on repetitive accounting tasks means more time for strategic activities that contribute directly to business growth such as market analysis, product development, and customer engagement. For online businesses, particularly smaller ones or those just starting out, manual entry might seem like a cost-effective option.

Each time an Amazon payout occurs, Link My Books efficiently generates a detailed summary invoice. This not only saves valuable time but also enhances accuracy as each entry is verified against actual bank transactions. Automatic Data SynchronizationAfter configuring your preferences, Link My Books will start syncing your Amazon payout data with Xero automatically.

The Future of Ecommerce: Leveraging Technology like Link My Books for Better Financial ManagementAutomating Ecommerce Financials with Link My BooksAs ecommerce continues to evolve, the integration of financial management tools like Link My Books with accounting software such as Xero becomes increasingly crucial.

The ability to reconcile transactions with a single click not only saves time but also reduces the complexities traditionally associated with accounting tasks. By automating these processes, business owners can avoid common bookkeeping errors that might otherwise affect their financial reports. This efficiency extends beyond simple bookkeeping; it aids in maintaining accurate financial records that reflect the true state of your business finances at all times. This not only speeds up the bookkeeping process but also reduces the chances of discrepancies that might otherwise lead to financial inaccuracies. As a round upIntegrating Amazon with Xero using platforms such as Link My Books transforms ecommerce finance management from a potential headache into a streamlined component of business strategy that supports growth and compliance simultaneously. Since VAT and other taxes are correctly calculated and reported based on real-time data provided by Amazon settlements, businesses can avoid overpayments or underpayments of tax liabilities. A fashion accessories seller found that inaccuracies in VAT returns due to manual bookkeeping had previously put their business at risk. In effect this means,embracing an automated solution like Link My Books for syncing your Amazon payouts with Xero not only simplifies the entire accounting process but significantly enhances its reliability and accuracy too. Simplified Reconciliation ProcessThe reconciliation process becomes a breeze with each payment received from Amazon being matched precisely with bank deposits in Xero.

This robust solution not only saves time but also enhances accuracy in financial reporting-critical aspects that facilitate smoother operations and better fiscal health for ecommerce businesses operating on platforms like Amazon. A common mistake is not accurately accounting for these taxes or missing deadlines for tax returns. Ensuring Tax EfficiencyTax efficiency is another critical aspect seamlessly addressed by integrating Link My Books with Xero. Business owners have full control over their entries, which allows for immediate personal oversight but requires a significant time investment and meticulous attention to detail. This shift in focus from administrative tasks to growth-oriented activities can be pivotal in scaling an online retail business efficiently. In effect this meansThe integration of Amazon with Xero facilitated by services like Link My Books not only simplifies VAT reporting but also enhances overall business efficiency. Personalizing Your Approach to Online Sales: Tailoring Link My Books Settings for Maximum EfficiencyUnderstanding the Basics of Link My Books and Xero IntegrationLink My Books is designed to streamline the process of Amazon FBA accounting, making it as straightforward as possible. Focus on Business GrowthWith bookkeeping tasks handled automatically, ecommerce entrepreneurs can dedicate more time and energy towards strategic activities such as market expansion, customer engagement, and product development.

This accuracy not only saves time during month-end closures but also ensures compliance with tax obligations and prevents costly errors that might occur due to manual handling. To avoid this, it's crucial to implement a robust accounting system like Xero, which allows for detailed tracking and categorization. What Every Ecommerce Entrepreneur Should Know About Financial ReconciliationUnderstanding the Basics of Financial ReconciliationFinancial reconciliation is a critical process for ecommerce entrepreneurs, especially those selling on platforms like Amazon. Enhanced Focus on Business GrowthBy handling the intricate aspects of accounting, Link My Books frees up business owners to concentrate on expanding their operations and improving market competitiveness. Automation not only saves valuable time but also reduces the likelihood of human error in accounting entries. Automated tools like Link My Books simplify this task by generating a clean summary invoice for each payout. Cost Savings Through AutomationAutomating ecommerce bookkeeping leads to significant cost savings by reducing the need for extensive manual labor and minimizing errors that could lead to financial penalties or duplicated work efforts. Amazon product inventory in Xero These automated summaries perfectly match the deposits made into a business's bank account, facilitating a simplified reconciliation process.

Every payout from Amazon generates a summary invoice in Xero that simplifies reconciliation to just a click, streamlining operations significantly. The seamless integration of Amazon to Xero ensures that every transaction is recorded without discrepancies. Neglecting Regular Financial ReviewsLastly, some Amazon sellers may not conduct regular reviews of their financial health, which hampers strategic decision-making and may lead to undetected errors persisting over time. These include sales, refunds, fees, VAT, and more. This automation significantly reduces the time spent on manual entry and increases the accuracy of financial records by minimizing human error. However, with each invoice generated mirroring the actual bank deposits, reconciliation becomes a single-click task within Xero. This automation ensures every transaction is recorded without manual intervention, reducing errors and saving valuable time that could otherwise be spent on strategic business activities. This precise matching simplifies the reconciliation process to a mere single click task within Xero.

Enhanced Tax EfficiencyAccurate accounting practices are central to running a tax-efficient business operation. Enhanced Focus on Business GrowthBy handling routine accounting tasks automatically, Link My Books frees up entrepreneurs to focus on more strategic aspects such as market expansion, customer engagement, and product development. Amazon FBA Xero integration Link My Books addresses this challenge by automating much of the process which not only saves time but also cuts down on costs associated with manual entry or potential errors. This process ensures that every payout from Amazon is directly integrated into Xero, capturing detailed transactions such as sales, refunds, fees, and VAT. In effect this means that integrating Amazon sales into Xero not only streamlines financial processes but also enhances accuracy and saves significant time for ecommerce business owners. Accurate bookkeeping minimizes the risks associated with incorrect tax filings which can lead to legal issues or financial penalties. As ecommerce continues to grow in complexity and scale, having a robust system that secures tax efficiency becomes invaluable. Accurate bookkeeping supports better financial decision-making while freeing up valuable time that can be invested back into strategic planning and execution. You will need to authorize Link My Books to access both your Amazon Seller Central account and your Xero account.

By syncing your Amazon payout data with Xero automatically, the system simplifies what used to be a complex part of business management. This automation ensures that every transaction from Amazon FBA sales to refunds and associated fees is captured without manual entry. Enhanced Reconciliation ProcessesWith each Amazon payout, tools like Link My Books generate detailed summary invoices that break down financial activities into clear categories. Accurate Bookkeeping Enhances Tax EfficiencyAccuracy in bookkeeping is paramount when it comes to managing finances in a tax-efficient manner. This shift not only helps in scaling up operations but also in maintaining a competitive edge in the marketplace. The integration simplifies this by breaking down settlements directly in Xero. This not only ensures accuracy but also simplifies reconciliation in Xero to just a single click. It ensures that every transaction is accounted for correctly, leaving no room for discrepancies or human error.

Automated processes ensure accuracy and free up resources allowing business owners to concentrate on growth rather than getting bogged down by complex accounting requirements. The Role of Automation in Enhancing Ecommerce Profit MarginsStreamlining Financial WorkflowsAutomation in ecommerce, particularly through integrations like Amazon to Xero, significantly streamlines financial workflows. Automating this process greatly diminishes such risks by ensuring consistent accuracy across all recorded transactions. Improved Tax EfficiencyTax management can be fraught with complications, especially when dealing with multifaceted platforms like Amazon. A home decor vendor shared how prior inconsistencies in their tax reports were a constant headache. These insights are invaluable for making informed decisions that propel business growth and provide a competitive edge in the marketplace. This not only prevents potential legal issues but also optimizes cash flow management. The ability to sync this data on autopilot can drastically cut down on time spent on bookkeeping and reduce the risk of errors.

Knowing that your financial records are being handled accurately and efficiently provides peace of mind and frees up time to focus on marketing strategies, product development, or customer engagement which are critical for business expansion. It involves matching your internal financial records against external records, such as bank statements or transaction reports from Amazon, to ensure accuracy in your finances. The result matches perfectly with the bank deposit received, which facilitates effortless reconciliation-often reducible to just one click in Xero. In effect this meansthe integration tools like those offered between Amazon and Xero present indispensable resources for any growing online retail business aiming to scale efficiently while maintaining rigorous financial order. This method provides a hands-on approach to managing sales, refunds, fees, and taxes such as VAT. Ultimately, this integration leads to better financial health through precise tracking, analysis, and timely reconciliations-enabling businesses to scale efficiently while maintaining tax efficiency. By ensuring that all transactions are synced on autopilot, ecommerce business owners can focus their efforts on other aspects of their business rather than spending time on tedious bookkeeping tasks. Each time you receive a payout, the software automatically syncs this data with Xero.

Given that many Amazon sellers experience challenges with accurate accounting, leveraging such integrations can be crucial for maintaining compliance and optimizing tax outcomes. Focus on Core Business ActivitiesThe automation of accounting processes allows ecommerce business owners to redirect their focus towards core activities such as market expansion and strategy refinement. Common Bookkeeping Mistakes Amazon Sellers Make and How to Avoid ThemMisclassifying Expenses and IncomeOne of the most common mistakes Amazon sellers make in their bookkeeping is the misclassification of expenses and income. This feature ensures that every transaction from Amazon, including sales, refunds, and fees, is recorded directly in Xero without manual input. Breakdown of Amazon SettlementsOne of the key features offered by integration tools such as Link My Books is the detailed breakdown of Amazon settlements.

With correct practices in place facilitated by technology like Xero integration with Amazon through Link My Books, businesses reduce risks associated with incorrect VAT returns or tax discrepancies. It's about redefining practices that once consumed substantial time so that focus can shift towards scaling your business effectively while remaining compliant and efficient in financial management.24. Detailed Financial BreakdownKey to managing an online retail business effectively is understanding where money is spent and earned. Simplified Settlement BreakdownsUnderstanding the complexities of each Amazon settlement is crucial for accurate bookkeeping.

Effortless ReconciliationThe true power of integrating Amazon with Xero lies in streamlined bank reconciliation processes. This modern approach not only saves considerable time but also improves overall efficiency in financial reporting. Without this check, discrepancies can go unnoticed, potentially leading to cash flow issues or errors in financial statements. The automated system provided by Link My Books minimizes the time spent on bookkeeping, which typically consumes substantial amounts of time and resources. Import Amazon settlements to Xero

It aids businesses in understanding their financial health better by providing insights into which areas are generating profits and which are causing losses. This precise matching simplifies the reconciliation process immensely. On the other hand, investing in automation software may involve upfront costs but typically leads to savings over time through increased efficiency and fewer mistakes. Xero integration for Amazon sellers Detailed Financial BreakdownsAn efficient integration provides detailed breakdowns of Amazon settlements into various categories like sales, refunds, fees, VAT, and more within Xero.

| Part of a series on |

| Accounting |

|---|

|

|

| Business administration |

|---|

| Management of a business |

|

Accounting, also known as accountancy, is the process of recording and processing information about economic entities, such as businesses and corporations.[1][2] Accounting measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators.[3] Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used interchangeably.[4]

Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting.[5] Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers.[6] Management accounting focuses on the measurement, analysis and reporting of information for internal use by management to enhance business operations.[1][6] The recording of financial transactions, so that summaries of the financials may be presented in financial reports, is known as bookkeeping, of which double-entry bookkeeping is the most common system.[7] Accounting information systems are designed to support accounting functions and related activities.

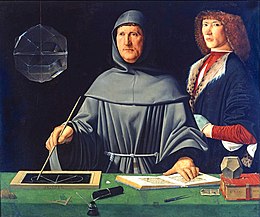

Accounting has existed in various forms and levels of sophistication throughout human history. The double-entry accounting system in use today was developed in medieval Europe, particularly in Venice, and is usually attributed to the Italian mathematician and Franciscan friar Luca Pacioli.[8] Today, accounting is facilitated by accounting organizations such as standard-setters, accounting firms and professional bodies. Financial statements are usually audited by accounting firms,[9] and are prepared in accordance with generally accepted accounting principles (GAAP).[6] GAAP is set by various standard-setting organizations such as the Financial Accounting Standards Board (FASB) in the United States[1] and the Financial Reporting Council in the United Kingdom. As of 2012, "all major economies" have plans to converge towards or adopt the International Financial Reporting Standards (IFRS).[10][11]

Accounting is thousands of years old and can be traced to ancient civilizations.[12][13][14] One early development of accounting dates back to ancient Mesopotamia and is closely related to developments in writing, counting and money;[12] there is also evidence of early forms of bookkeeping in ancient Iran,[15][16] and early auditing systems by the ancient Egyptians and Babylonians.[13] By the time of Emperor Augustus, the Roman government had access to detailed financial information.[17]

Many concepts related to today's accounting seem to be initiated in medieval's Middle East. For example, Jewish communities used double-entry bookkeeping in the early-medieval period[18][19] and Muslim societies, at least since the 10th century also used many modern accounting concepts.[20]

The spread of the use of Arabic numerals, instead of the Roman numbers historically used in Europe, increased efficiency of accounting procedures among Mediterranean merchants,[21] who further refined accounting in medieval Europe.[22] With the development of joint-stock companies, accounting split into financial accounting and management accounting.

The first published work on a double-entry bookkeeping system was the Summa de arithmetica, published in Italy in 1494 by Luca Pacioli (the "Father of Accounting").[23][24] Accounting began to transition into an organized profession in the nineteenth century,[25][26] with local professional bodies in England merging to form the Institute of Chartered Accountants in England and Wales in 1880.[27]

Both the words "accounting" and "accountancy" were in use in Great Britain by the mid-1800s and are derived from the words accompting and accountantship used in the 18th century.[28] In Middle English (used roughly between the 12th and the late 15th century), the verb "to account" had the form accounten, which was derived from the Old French word aconter,[29] which is in turn related to the Vulgar Latin word computare, meaning "to reckon". The base of computare is putare, which "variously meant to prune, to purify, to correct an account, hence, to count or calculate, as well as to think".[29]

The word "accountant" is derived from the French word compter, which is also derived from the Italian and Latin word computare. The word was formerly written in English as "accomptant", but in process of time the word, which was always pronounced by dropping the "p", became gradually changed both in pronunciation and in orthography to its present form.[30]

Accounting has variously been defined as the keeping or preparation of the financial records of transactions of the firm, the analysis, verification and reporting of such records and "the principles and procedures of accounting"; it also refers to the job of being an accountant.[31][32][33]

Accountancy refers to the occupation or profession of an accountant,[34][35][36] particularly in British English.[31][32]

Accounting has several subfields or subject areas, including financial accounting, management accounting, auditing, taxation and accounting information systems.[5]

Financial accounting focuses on the reporting of an organization's financial information to external users of the information, such as investors, potential investors and creditors. It calculates and records business transactions and prepares financial statements for the external users in accordance with generally accepted accounting principles (GAAP).[6] GAAP, in turn, arises from the wide agreement between accounting theory and practice, and changes over time to meet the needs of decision-makers.[1]

Financial accounting produces past-oriented reports—for example financial statements are often published six to ten months after the end of the accounting period—on an annual or quarterly basis, generally about the organization as a whole.[6]

Management accounting focuses on the measurement, analysis and reporting of information that can help managers in making decisions to fulfill the goals of an organization. In management accounting, internal measures and reports are based on cost–benefit analysis, and are not required to follow the generally accepted accounting principle (GAAP).[6] In 2014 CIMA created the Global Management Accounting Principles (GMAPs). The result of research from across 20 countries in five continents, the principles aim to guide best practice in the discipline.[37]

Management accounting produces past-oriented reports with time spans that vary widely, but it also encompasses future-oriented reports such as budgets. Management accounting reports often include financial and non financial information, and may, for example, focus on specific products and departments.[6]

Intercompany accounting focuses on the measurement, analysis and reporting of information between separate entities that are related, such as a parent company and its subsidiary companies. Intercompany accounting concerns record keeping of transactions between companies that have common ownership such as a parent company and a partially or wholly owned subsidiary. Intercompany transactions are also recorded in accounting when business is transacted between companies with a common parent company (subsidiaries).[38][39]

Auditing is the verification of assertions made by others regarding a payoff,[40] and in the context of accounting it is the "unbiased examination and evaluation of the financial statements of an organization".[41] Audit is a professional service that is systematic and conventional.[42]

An audit of financial statements aims to express or disclaim an independent opinion on the financial statements. The auditor expresses an independent opinion on the fairness with which the financial statements presents the financial position, results of operations, and cash flows of an entity, in accordance with the generally accepted accounting principles (GAAP) and "in all material respects". An auditor is also required to identify circumstances in which the generally accepted accounting principles (GAAP) have not been consistently observed.[43]

An accounting information system is a part of an organization's information system used for processing accounting data.[44] Many corporations use artificial intelligence-based information systems. The banking and finance industry uses AI in fraud detection. The retail industry uses AI for customer services. AI is also used in the cybersecurity industry. It involves computer hardware and software systems using statistics and modeling.[45]

Many accounting practices have been simplified with the help of accounting computer-based software. An enterprise resource planning (ERP) system is commonly used for a large organisation and it provides a comprehensive, centralized, integrated source of information that companies can use to manage all major business processes, from purchasing to manufacturing to human resources. These systems can be cloud based and available on demand via application or browser, or available as software installed on specific computers or local servers, often referred to as on-premise.

Tax accounting in the United States concentrates on the preparation, analysis and presentation of tax payments and tax returns. The U.S. tax system requires the use of specialised accounting principles for tax purposes which can differ from the generally accepted accounting principles (GAAP) for financial reporting.[46] U.S. tax law covers four basic forms of business ownership: sole proprietorship, partnership, corporation, and limited liability company. Corporate and personal income are taxed at different rates, both varying according to income levels and including varying marginal rates (taxed on each additional dollar of income) and average rates (set as a percentage of overall income).[46]

This section does not cite any sources. (June 2023) |

Forensic accounting is a specialty practice area of accounting that describes engagements that result from actual or anticipated disputes or litigation.[47] "Forensic" means "suitable for use in a court of law", and it is to that standard and potential outcome that forensic accountants generally have to work.

Political campaign accounting deals with the development and implementation of financial systems and the accounting of financial transactions in compliance with laws governing political campaign operations. This branch of accounting was first formally introduced in the March 1976 issue of The Journal of Accountancy.[48]

Professional accounting bodies include the American Institute of Certified Public Accountants (AICPA) and the other 179 members of the International Federation of Accountants (IFAC),[49] including Institute of Chartered Accountants of Scotland (ICAS), Institute of Chartered Accountants of Pakistan (ICAP), CPA Australia, Institute of Chartered Accountants of India, Association of Chartered Certified Accountants (ACCA) and Institute of Chartered Accountants in England and Wales (ICAEW). Some countries have a single professional accounting body and, in some other countries, professional bodies for subfields of the accounting professions also exist, for example the Chartered Institute of Management Accountants (CIMA) in the UK and Institute of management accountants in the United States.[50] Many of these professional bodies offer education and training including qualification and administration for various accounting designations, such as certified public accountant (AICPA) and chartered accountant.[51][52]

Depending on its size, a company may be legally required to have their financial statements audited by a qualified auditor, and audits are usually carried out by accounting firms.[9]

Accounting firms grew in the United States and Europe in the late nineteenth and early twentieth century, and through several mergers there were large international accounting firms by the mid-twentieth century. Further large mergers in the late twentieth century led to the dominance of the auditing market by the "Big Five" accounting firms: Arthur Andersen, Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers.[53] The demise of Arthur Andersen following the Enron scandal reduced the Big Five to the Big Four.[54]

Generally accepted accounting principles (GAAP) are accounting standards issued by national regulatory bodies. In addition, the International Accounting Standards Board (IASB) issues the International Financial Reporting Standards (IFRS) implemented by 147 countries.[1] Standards for international audit and assurance, ethics, education, and public sector accounting are all set by independent standard settings boards supported by IFAC. The International Auditing and Assurance Standards Board sets international standards for auditing, assurance, and quality control; the International Ethics Standards Board for Accountants (IESBA) [55] sets the internationally appropriate principles-based Code of Ethics for Professional Accountants; the International Accounting Education Standards Board (IAESB) sets professional accounting education standards;[56] and International Public Sector Accounting Standards Board (IPSASB) sets accrual-based international public sector accounting standards.[57][4]

Organizations in individual countries may issue accounting standards unique to the countries. For example, in Australia, the Australian Accounting Standards Board manages the issuance of the accounting standards in line with IFRS. In the United States the Financial Accounting Standards Board (FASB) issues the Statements of Financial Accounting Standards, which form the basis of US GAAP,[1] and in the United Kingdom the Financial Reporting Council (FRC) sets accounting standards.[58] However, as of 2012 "all major economies" have plans to converge towards or adopt the IFRS.[10]

At least a bachelor's degree in accounting or a related field is required for most accountant and auditor job positions, and some employers prefer applicants with a master's degree.[59] A degree in accounting may also be required for, or may be used to fulfill the requirements for, membership to professional accounting bodies. For example, the education during an accounting degree can be used to fulfill the American Institute of CPA's (AICPA) 150 semester hour requirement,[60] and associate membership with the Certified Public Accountants Association of the UK is available after gaining a degree in finance or accounting.[61]

A doctorate is required in order to pursue a career in accounting academia, for example, to work as a university professor in accounting.[62][63] The Doctor of Philosophy (PhD) and the Doctor of Business Administration (DBA) are the most popular degrees. The PhD is the most common degree for those wishing to pursue a career in academia, while DBA programs generally focus on equipping business executives for business or public careers requiring research skills and qualifications.[62]

Professional accounting qualifications include the chartered accountant designations and other qualifications including certificates and diplomas.[64] In Scotland, chartered accountants of ICAS undergo Continuous Professional Development and abide by the ICAS code of ethics.[65] In England and Wales, chartered accountants of the ICAEW undergo annual training, and are bound by the ICAEW's code of ethics and subject to its disciplinary procedures.[66]

In the United States, the requirements for joining the AICPA as a Certified Public Accountant are set by the Board of Accountancy of each state, and members agree to abide by the AICPA's Code of Professional Conduct and Bylaws.

The ACCA is the largest global accountancy body with over 320,000 members, and the organisation provides an 'IFRS stream' and a 'UK stream'. Students must pass a total of 14 exams, which are arranged across three levels.[67]

Accounting research is research in the effects of economic events on the process of accounting, the effects of reported information on economic events, and the roles of accounting in organizations and society.[68][69] It encompasses a broad range of research areas including financial accounting, management accounting, auditing and taxation.[70]

Accounting research is carried out both by academic researchers and practicing accountants. Methodologies in academic accounting research include archival research, which examines "objective data collected from repositories"; experimental research, which examines data "the researcher gathered by administering treatments to subjects"; analytical research, which is "based on the act of formally modeling theories or substantiating ideas in mathematical terms"; interpretive research, which emphasizes the role of language, interpretation and understanding in accounting practice, "highlighting the symbolic structures and taken-for-granted themes which pattern the world in distinct ways"; critical research, which emphasizes the role of power and conflict in accounting practice; case studies; computer simulation; and field research.[71][72]

Empirical studies document that leading accounting journals publish in total fewer research articles than comparable journals in economics and other business disciplines,[73] and consequently, accounting scholars[74] are relatively less successful in academic publishing than their business school peers.[75] Due to different publication rates between accounting and other business disciplines, a recent study based on academic author rankings concludes that the competitive value of a single publication in a top-ranked journal is highest in accounting and lowest in marketing.[76]

The year 2001 witnessed a series of financial information frauds involving Enron, auditing firm Arthur Andersen, the telecommunications company WorldCom, Qwest and Sunbeam, among other well-known corporations. These problems highlighted the need to review the effectiveness of accounting standards, auditing regulations and corporate governance principles. In some cases, management manipulated the figures shown in financial reports to indicate a better economic performance. In others, tax and regulatory incentives encouraged over-leveraging of companies and decisions to bear extraordinary and unjustified risk.[77]

The Enron scandal deeply influenced the development of new regulations to improve the reliability of financial reporting, and increased public awareness about the importance of having accounting standards that show the financial reality of companies and the objectivity and independence of auditing firms.[77]

In addition to being the largest bankruptcy reorganization in American history, the Enron scandal undoubtedly is the biggest audit failure[78] causing the dissolution of Arthur Andersen, which at the time was one of the five largest accounting firms in the world. After a series of revelations involving irregular accounting procedures conducted throughout the 1990s, Enron filed for Chapter 11 bankruptcy protection in December 2001.[79]

One consequence of these events was the passage of the Sarbanes–Oxley Act in the United States in 2002, as a result of the first admissions of fraudulent behavior made by Enron. The act significantly raises criminal penalties for securities fraud, for destroying, altering or fabricating records in federal investigations or any scheme or attempt to defraud shareholders.[80]

Accounting fraud is an intentional misstatement or omission in the accounting records by management or employees which involves the use of deception. It is a criminal act and a breach of civil tort. It may involve collusion with third parties.[81]

An accounting error is an unintentional misstatement or omission in the accounting records, for example misinterpretation of facts, mistakes in processing data, or oversights leading to incorrect estimates.[81] Acts leading to accounting errors are not criminal but may breach civil law, for example, the tort of negligence.

The primary responsibility for the prevention and detection of fraud and errors rests with the entity's management.[81]

Vat or VAT may refer to:

This article needs additional citations for verification. (December 2013) |

| Bookkeeping |

|---|

| Key concepts |

|

| Financial statements |

|

| Related professions |

|

| Part of a series on |

| Accounting |

|---|

|

|

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations.[1] It involves preparing source documents for all transactions, operations, and other events of a business. Transactions include purchases, sales, receipts and payments by an individual person, organization or corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process.

The person in an organisation who is employed to perform bookkeeping functions is usually called the bookkeeper (or book-keeper). They usually write the daybooks (which contain records of sales, purchases, receipts, and payments), and document each financial transaction, whether cash or credit, into the correct daybook—that is, petty cash book, suppliers ledger, customer ledger, etc.—and the general ledger. Thereafter, an accountant can create financial reports from the information recorded by the bookkeeper. The bookkeeper brings the books to the trial balance stage, from which an accountant may prepare financial reports for the organisation, such as the income statement and balance sheet.

The origin of book-keeping is lost in obscurity, but recent research indicates that methods of keeping accounts have existed from the remotest times of human life in cities. Babylonian records written with styli on small slabs of clay have been found dating to 2600 BC.[2] Mesopotamian bookkeepers kept records on clay tablets that may date back as far as 7,000 years. Use of the modern double entry bookkeeping system was described by Luca Pacioli in 1494.[3]

The term "waste book" was used in colonial America, referring to the documenting of daily transactions of receipts and expenditures. Records were made in chronological order, and for temporary use only. Daily records were then transferred to a daybook or account ledger to balance the accounts and to create a permanent journal; then the waste book could be discarded, hence the name.[4]

The primary purpose of bookkeeping is to record the financial effects of transactions. An important difference between a manual and an electronic accounting system is the former's latency between the recording of a financial transaction and its posting in the relevant account. This delay, which is absent in electronic accounting systems due to nearly instantaneous posting to relevant accounts, is characteristic of manual systems, and gave rise to the primary books of accounts—cash book, purchase book, sales book, etc.—for immediately documenting a financial transaction.

In the normal course of business, a document is produced each time a transaction occurs. Sales and purchases usually have invoices or receipts. Historically, deposit slips were produced when lodgements (deposits) were made to a bank account; and checks (spelled "cheques" in the UK and several other countries) were written to pay money out of the account. Nowadays such transactions are mostly made electronically. Bookkeeping first involves recording the details of all of these source documents into multi-column journals (also known as books of first entry or daybooks). For example, all credit sales are recorded in the sales journal; all cash payments are recorded in the cash payments journal. Each column in a journal normally corresponds to an account. In the single entry system, each transaction is recorded only once. Most individuals who balance their check-book each month are using such a system, and most personal-finance software follows this approach.

After a certain period, typically a month, each column in each journal is totalled to give a summary for that period. Using the rules of double-entry, these journal summaries are then transferred to their respective accounts in the ledger, or account book. For example, the entries in the Sales Journal are taken and a debit entry is made in each customer's account (showing that the customer now owes us money), and a credit entry might be made in the account for "Sale of class 2 widgets" (showing that this activity has generated revenue for us). This process of transferring summaries or individual transactions to the ledger is called posting. Once the posting process is complete, accounts kept using the "T" format (debits on the left side of the "T" and credits on the right side) undergo balancing, which is simply a process to arrive at the balance of the account.

As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created. In its simplest form, this is a three-column list. Column One contains the names of those accounts in the ledger which have a non-zero balance. If an account has a debit balance, the balance amount is copied into Column Two (the debit column); if an account has a credit balance, the amount is copied into Column Three (the credit column). The debit column is then totalled, and then the credit column is totalled. The two totals must agree—which is not by chance—because under the double-entry rules, whenever there is a posting, the debits of the posting equal the credits of the posting. If the two totals do not agree, an error has been made, either in the journals or during the posting process. The error must be located and rectified, and the totals of the debit column and the credit column recalculated to check for agreement before any further processing can take place.

Once the accounts balance, the accountant makes a number of adjustments and changes the balance amounts of some of the accounts. These adjustments must still obey the double-entry rule: for example, the inventory account and asset account might be changed to bring them into line with the actual numbers counted during a stocktake. At the same time, the expense account associated with use of inventory is adjusted by an equal and opposite amount. Other adjustments such as posting depreciation and prepayments are also done at this time. This results in a listing called the adjusted trial balance. It is the accounts in this list, and their corresponding debit or credit balances, that are used to prepare the financial statements.

Finally financial statements are drawn from the trial balance, which may include:

The primary bookkeeping record in single-entry bookkeeping is the cash book, which is similar to a checking account register (in UK: cheque account, current account), except all entries are allocated among several categories of income and expense accounts. Separate account records are maintained for petty cash, accounts payable and accounts receivable, and other relevant transactions such as inventory and travel expenses. To save time and avoid the errors of manual calculations, single-entry bookkeeping can be done today with do-it-yourself bookkeeping software.

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different ledger accounts.